Purchasing an industrial oil-fired boiler is a significant capital investment, often involving high upfront costs for equipment, installation, and auxiliary systems. For many companies, securing the necessary funding while ensuring a reasonable payback period can be challenging. Fortunately, a variety of financing mechanisms and government-backed incentives are available to ease the financial burden and improve return on investment—especially when efficiency, emissions control, or modernization are involved.

Financing and incentive options for industrial oil-fired boiler purchases may include equipment leasing, capital loans, energy efficiency grants, tax deductions, emissions reduction subsidies, and government energy programs. These options can help reduce initial capital outlay, improve cash flow, or offset costs tied to energy efficiency improvements or emissions compliance. Qualification depends on boiler specifications, project scope, industry sector, and regional policy frameworks.

Below is a guide to the most common and beneficial financing avenues for industrial boiler investments.

What Are the Common Financing Options for Industrial Oil-Fired Boilers (Leasing, Loans, Vendor Credit)?

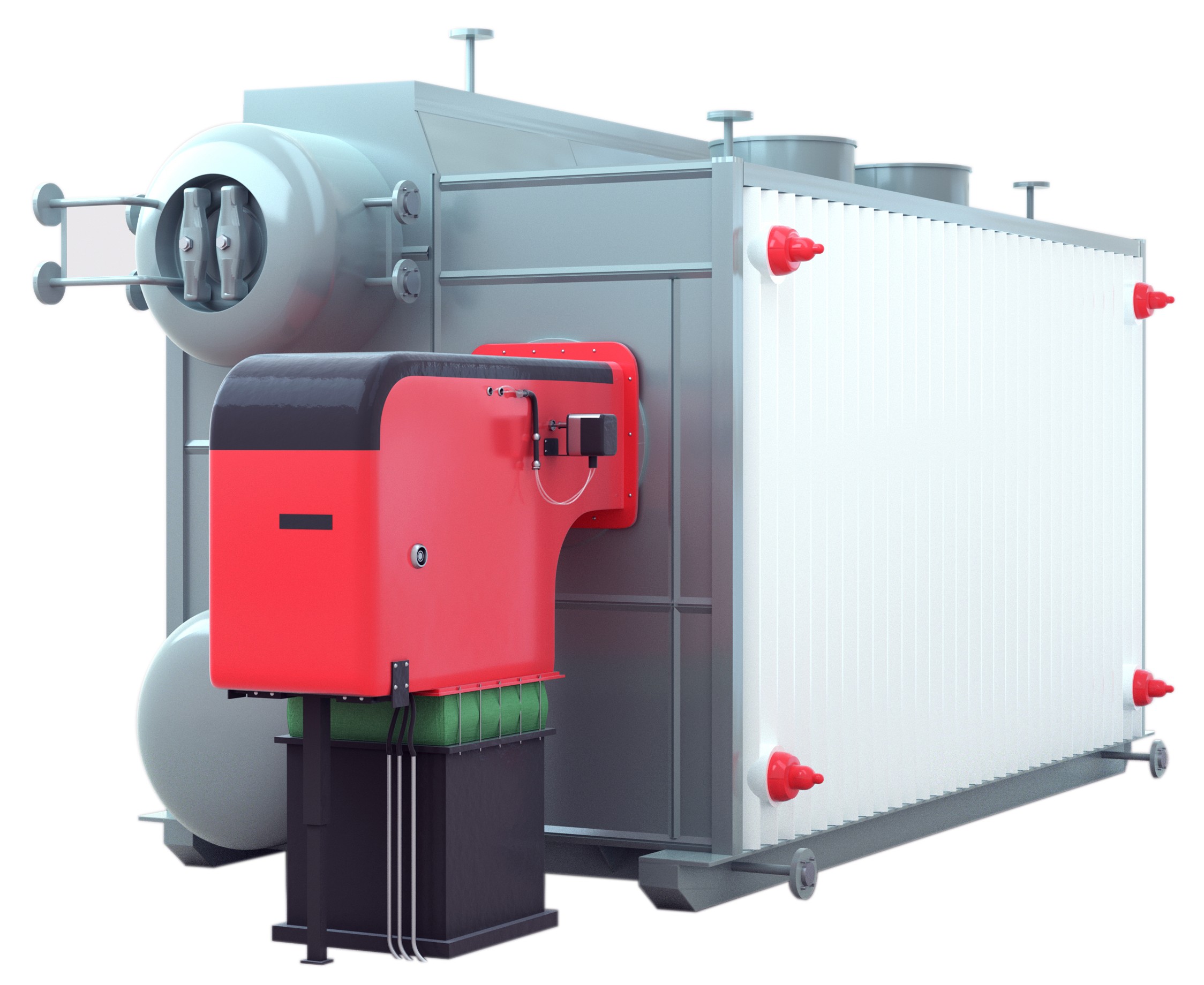

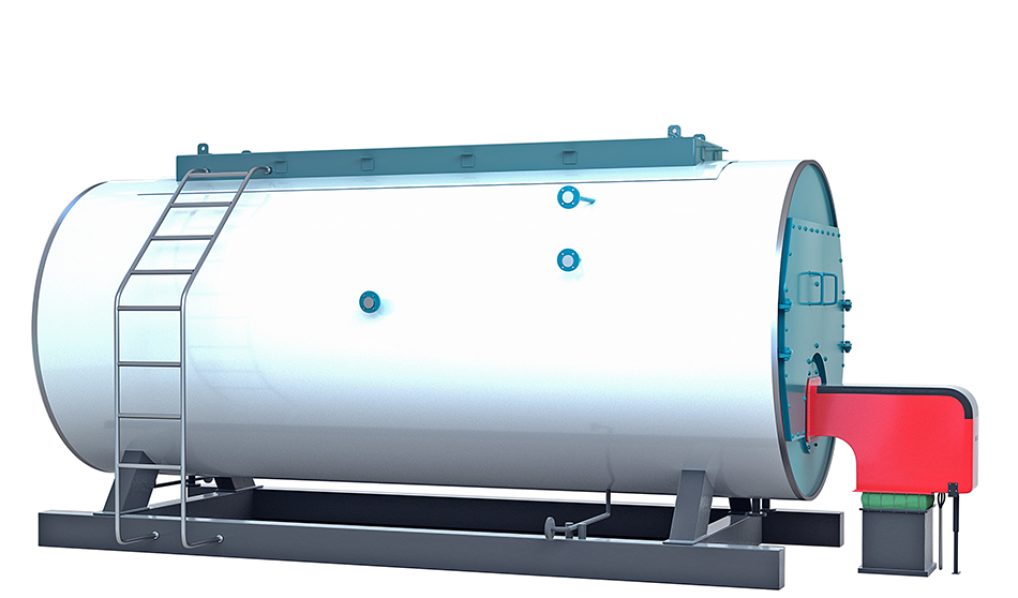

Industrial oil-fired boilers are a critical component in sectors such as manufacturing, food processing, textiles, petrochemicals, and institutional heating. But while these systems are compact and versatile, they come with a significant upfront investment—often ranging from $50,000 to over $500,000, depending on capacity and configuration. To ease this burden and align purchases with cash flow or project cycles, many companies explore financing options such as equipment leasing, commercial loans, and vendor credit arrangements. Choosing the right financial strategy can significantly affect the Total Cost of Ownership (TCO), tax liability, and cash flow stability.

The most common financing options for industrial oil-fired boilers include operating or capital leasing, commercial equipment loans from banks or financial institutions, and vendor credit agreements from boiler manufacturers or distributors. Each option offers different advantages in terms of ownership, tax benefits, initial cost reduction, repayment flexibility, and balance sheet treatment. The optimal solution depends on the buyer’s cash position, credit profile, and operational strategy.

Rather than delaying a critical equipment upgrade, smart financing unlocks timely installation, efficiency gains, and emissions compliance.

Leasing, equipment loans, and vendor credit are the three most commonly used financing options for industrial boiler systems.True

These methods offer flexibility and help businesses avoid large up-front capital expenditures.

🏦 1. Commercial Equipment Loans

| Feature | Description |

|---|---|

| Loan Structure | Fixed term (typically 3–7 years) |

| Ownership | Buyer owns the boiler once financed |

| Payment Model | Monthly principal + interest |

| Typical Interest Rate | 6–12% (credit and collateral dependent) |

| Down Payment | Usually 10–20% |

| Lender Type | Banks, credit unions, or equipment financiers |

🔍 Pros:

You own the boiler at the end.

May offer depreciation and Section 179 tax benefits.

Predictable amortization for budgeting.

🔍 Cons:

May require strong credit or collateral.

Ties up capital that could be used elsewhere.

🧾 2. Equipment Leasing (Operating or Capital Lease)

| Type | Operating Lease | Capital Lease |

|---|---|---|

| Ownership | Lessor retains ownership | Lessee owns at end (via buyout) |

| Balance Sheet | Off balance sheet (short-term asset) | On balance sheet (capital asset) |

| Term | 2–5 years typically | 3–7 years |

| Buyout Option | No (or FMV purchase) | Yes ($1 or pre-agreed price) |

| Tax Treatment | Lease payments are fully deductible | Interest and depreciation deductible |

🧮 Typical Leasing Rates:

Monthly Payment Range: $900 – $5,000+

Total Lease Cost (5 years): $60,000 – $300,000+

🔍 Pros:

Low or no upfront capital.

Preserves working capital and credit lines.

Easier approval process than traditional loans.

🔍 Cons:

Higher long-term cost vs. direct purchase.

No equity unless capital lease is structured.

🤝 3. Vendor Financing & Deferred Payment Programs

| Feature | Description |

|---|---|

| Provider | Boiler OEMs or distributors |

| Structure | Installment contract or short-term credit |

| Term | 6–36 months typically |

| Down Payment | Often 0–15% |

| Interest Rate | Varies—can be 0% for promotional terms |

🔍 Pros:

Fast approval and minimal paperwork.

Often bundled with service/maintenance packages.

Can be negotiated alongside system purchase.

🔍 Cons:

Limited to vendor’s financial capabilities.

Terms may be less competitive than independent lenders.

📊 Financing Option Comparison Table

| Option | Ownership | Down Payment | Tax Benefits | Monthly Cost | Flexibility | Typical Term |

|---|---|---|---|---|---|---|

| Equipment Loan | Yes | 10–20% | Depreciation + Interest | $$–$$$ | Medium | 3–7 years |

| Operating Lease | No | 0–10% | 100% deductible lease | $–$$$ | High | 2–5 years |

| Capital Lease | Yes | Low | Depreciation + Interest | $$–$$$ | Medium | 3–7 years |

| Vendor Credit | Sometimes | 0–15% | Limited | $–$$ | High | 6–36 months |

📈 Strategic Financing Considerations

| Business Goal | Recommended Option |

|---|---|

| Maximize short-term cash flow | Operating lease |

| Long-term equipment ownership | Capital lease or loan |

| Simplify procurement + installation | Vendor financing |

| Leverage tax benefits | Loan or capital lease |

| Rapid turnaround or limited credit | Vendor deferred payment |

Equipment leasing is increasingly preferred by mid-sized industrial firms seeking boiler upgrades without large upfront costs.True

Leasing offers flexible terms and avoids balance sheet liabilities while providing immediate access to upgraded systems.

Summary

For industrial oil-fired boilers, the choice of financing strategy can dramatically influence both short-term affordability and long-term profitability. Whether you’re aiming to preserve capital, secure ownership, or ease into emissions compliance, options like equipment loans, leasing, and vendor credit provide paths tailored to your financial structure and operational needs. By evaluating TCO, tax impact, and repayment structure, plant operators can install the right boiler without draining the balance sheet—and ensure heat and production keep flowing without financial friction.

Are There Tax Deductions or Accelerated Depreciation Programs Available for Boiler Investments?

When investing in an oil-fired boiler for industrial or commercial use, the financial benefits extend beyond operational efficiency and heat output. Tax incentives and depreciation programs can significantly reduce the net cost of the investment, especially in countries like the United States, Canada, and parts of Europe. These mechanisms—such as accelerated depreciation, Section 179 expensing, or green energy tax credits—can make an oil-fired boiler system substantially more affordable over the first few years of operation, improving return on investment (ROI) and cash flow.

Yes, industrial oil-fired boiler investments often qualify for tax deductions and accelerated depreciation programs such as IRS Section 179, bonus depreciation, and energy efficiency credits. These programs allow businesses to deduct part or all of the equipment cost from their taxable income in the year it was placed in service, or to accelerate depreciation over 5–7 years. In many jurisdictions, capital equipment like boilers is considered a qualifying asset under commercial tax law. Businesses should consult tax professionals to maximize allowable deductions and incentives.

If your boiler helps your production, it can also help reduce your tax burden.

Industrial oil-fired boilers qualify as capital assets eligible for accelerated depreciation and Section 179 deductions in the U.S.True

They are categorized under depreciable tangible personal property used in trade or business.

🧾 U.S. Federal Tax Incentives Overview (Example)

| Tax Mechanism | Description | Eligibility for Oil-Fired Boilers |

|---|---|---|

| Section 179 Deduction | Deduct full purchase price up to $1.16M (2023) | ✅ Eligible |

| Bonus Depreciation | 60% first-year depreciation (2025 phase-down) | ✅ Eligible |

| MACRS (Standard) | Depreciate over 5–7 years based on asset class | ✅ Eligible |

| Energy Efficiency Credits | May apply if system qualifies under local/state programs | 🔶 Varies by jurisdiction |

A $150,000 boiler can reduce taxable income by over $100,000 in the first year via Section 179 + bonus.

📊 Depreciation Methods – Impact Comparison

| Boiler Investment Value: $200,000 | MACRS (5-Year) | Section 179 + Bonus |

|---|---|---|

| Year 1 Depreciation | ~$40,000 | ~$160,000 |

| Year 2 Depreciation | ~$32,000 | ~$16,000 |

| Total Deducted in 2 Years | ~$72,000 | $176,000 |

| Tax Savings (@ 30% rate) | ~$21,600 | $52,800 |

The accelerated deduction front-loads savings, helping offset installation and start-up costs quickly.

📋 Eligibility Criteria for Depreciation & Deductions

| Requirement | Applies to Oil-Fired Boiler? |

|---|---|

| Tangible personal property | ✅ Yes |

| Used in active trade or business | ✅ Yes |

| Not acquired from a related party | ✅ Yes |

| Placed in service during tax year | ✅ Yes |

| Installed in the U.S. (for U.S. claims) | ✅ Yes |

| Used more than 50% for business use | ✅ Yes |

Oil-fired boilers installed for business use meet IRS criteria for full depreciation and Section 179 expensing.True

They qualify as machinery used in industrial processes and are not excluded assets.

🌎 International Incentives Snapshot

| Country | Depreciation Scheme | Deduction Notes |

|---|---|---|

| United States | Section 179 + MACRS/Bonus | Up to 100% expensing (phasing down) |

| Canada | Capital Cost Allowance (CCA) | CCA Class 43.1 or 43.2 (if high-efficiency) |

| UK | Annual Investment Allowance | 100% write-off up to £1M/year |

| Germany | AfA depreciation | Standard 5–10 years based on class |

| Australia | Instant Asset Write-Off | Up to AUD $150K for qualifying SMEs |

Regional green incentives may apply if efficiency or emissions improvements are demonstrated.

📈 Strategic Tax Planning Recommendations

| Strategy | Benefit |

|---|---|

| Use Section 179 early | Maximizes deduction and ROI in Year 1 |

| Pair with energy-efficiency audit | May qualify for additional local grants |

| Bundle multiple equipment purchases | Aggregate deductions across systems |

| Install before tax year-end | Ensures eligibility for current year |

| Consult a tax advisor | Ensures full compliance and optimization |

Summary

Industrial oil-fired boilers are not just an energy investment—they’re a tax strategy opportunity. Thanks to programs like Section 179 and accelerated depreciation, businesses can offset a substantial portion of their boiler system investment through tax savings—often recovering 30% or more in the first year alone. These deductions improve cash flow, boost ROI, and make modern, efficient heating systems more financially accessible. With strategic timing and expert planning, your boiler upgrade can heat more than just your facility—it can heat up your balance sheet too.

What Federal or Regional Energy Efficiency Incentives Support Boiler Upgrades?

Modernizing or replacing an industrial oil-fired boiler can drastically improve fuel efficiency, reduce operating costs, and lower harmful emissions—but the capital expense can be a barrier. To support energy efficiency improvements in commercial and industrial sectors, various federal and regional incentive programs offer tax deductions, rebates, and performance-based grants that directly offset boiler upgrade costs. While most incentives historically favored gas or renewable heating systems, many programs today include high-efficiency oil-fired boilers that meet specific emissions and thermal performance thresholds.

Yes, several federal and regional energy efficiency incentives are available to support oil-fired boiler upgrades, especially when systems achieve high thermal efficiency or contribute to emissions reductions. Programs such as Section 179 deductions, accelerated depreciation, commercial energy tax credits (179D), and utility energy rebate programs may cover 20–50% of eligible project costs. State energy agencies and air quality districts also offer grants for emissions control retrofits, burner upgrades, and high-efficiency oil boiler installations.

The right boiler upgrade can heat your facility—and cool down your capital expenses.

Oil-fired boiler projects can qualify for tax deductions, utility rebates, and state clean energy grants if they meet energy efficiency or emissions reduction benchmarks.True

High-efficiency and low-NOₓ oil boilers are increasingly recognized in incentive policies for industrial upgrades.

🏛️ Federal Tax-Based Incentives

| Program Name | Type | Relevance to Oil-Fired Boilers |

|---|---|---|

| Section 179 Deduction | Tax deduction | Deduct up to $1.16M in capital costs for eligible equipment (2023–2025) |

| Bonus Depreciation | Accelerated write-off | 60% first-year depreciation for equipment placed in service before 2026 |

| Section 179D (Commercial Buildings) | Deduction per square foot | HVAC and boiler retrofits in commercial buildings may qualify ($0.50–$1.00/sq ft) |

| Inflation Reduction Act (IRA) | Energy project credits | May apply to emissions-related retrofits or fuel-switching if oil boiler is replaced |

A qualifying boiler project could reduce taxable income by 25–35% of project cost using deductions alone.

🌎 Regional & Utility Rebates and Grants (U.S.)

| Region/Program | Incentive Type | Boiler-Related Benefit |

|---|---|---|

| NYSERDA (New York) | Performance grants | Oil boiler upgrades that improve efficiency >10% |

| Mass Save (MA) | Rebate | May support high-efficiency replacement (>85% AFUE) |

| California AQMD/CEC | Clean air grants | Incentives for low-NOₓ burners and oil system phase-out |

| Focus on Energy (WI) | Custom & prescriptive rebate | Case-by-case funding for oil system upgrades |

| PG&E (CA) | Custom incentive | Fuel savings-based rebate programs (oil-to-gas or upgrade) |

| PA DEP Small Business Advantage Grant | Energy efficiency grant | Up to $5,000 toward high-efficiency boiler replacement |

Many utility programs offer custom boiler rebates if the buyer can demonstrate measurable energy or emissions savings.

✅ Common Qualifying Criteria

| Requirement | Applies to Oil-Fired Boilers? |

|---|---|

| Efficiency improvement over baseline | ✅ Yes (typically >85% efficiency) |

| Emissions reduction (NOₓ, SO₂, CO₂) | ✅ Yes (especially with new burners) |

| Fuel cost savings | ✅ Yes (if fuel usage is monitored) |

| Pre-approval before purchase | ✅ Required for most state/utility programs |

| Installed by certified professionals | ✅ Often required for rebate release |

Oil boiler upgrade incentives often require pre-project application and post-installation verification to confirm energy or emissions savings.True

Incentive providers need assurance that public or utility funds support measurable efficiency gains.

📋 Real-World Example: Combined Incentive Impact

| Project: Replace 1.5 MMBtu/hr Oil Boiler | Cost | Incentive Type | Amount Saved |

|---|---|---|---|

| High-efficiency boiler (87% TE) | $85,000 | Section 179 deduction | $21,250 |

| Burner NOₓ retrofit | $15,000 | State Clean Air Grant | $7,500 |

| Control & O₂ Trim System | $12,000 | Utility custom rebate | $5,000 |

| Total Incentives | — | Combined | $33,750 |

| Effective Net Cost | — | — | $78,250 |

🧭 Steps to Access Incentives

| Step | Action Needed |

|---|---|

| Audit your existing boiler system | Quantify inefficiencies and emissions |

| Identify regional and federal programs | Use DSIRE database or state energy office |

| Request quotes for qualifying equipment | Include performance specs (AFUE, NOₓ) |

| Submit pre-approval forms if needed | Ensure eligibility before purchase |

| Install and retain documentation | Required for M&V and incentive reimbursement |

Summary

Industrial oil-fired boilers may not seem like the obvious candidate for energy efficiency incentives—but when properly specified and installed, they can qualify for a wide range of financial support from federal and state agencies. With tax deductions, custom rebates, and clean air grants, many facilities can reduce the net cost of an oil boiler retrofit by 20–50%, improving ROI and shortening payback periods. The key is to align the project with program requirements, submit all documentation correctly, and start early. With the right planning, your boiler upgrade could pay for itself—before it even fires up.

How Do Emissions Reduction Programs and Clean Air Funding Offset Boiler Compliance Costs?

Oil-fired boilers, while efficient and compact, are subject to increasingly strict air quality regulations aimed at reducing pollutants like NOₓ, SO₂, CO, PM, and greenhouse gases. Complying with these environmental mandates often requires upgrades such as low-NOₓ burners, oxygen trim systems, emissions monitoring, or boiler replacement. These improvements come with high capital and operational costs. However, emissions reduction programs and clean air funding mechanisms—available at federal, state, and regional levels—are designed to ease this financial burden through grants, rebates, technical assistance, and emissions trading credits.

Emissions reduction programs and clean air funding help offset compliance costs for oil-fired boilers by offering direct grants, equipment rebates, cost-sharing incentives, and access to emissions trading markets. These programs are administered by environmental agencies, utility commissions, and government energy departments to encourage pollution control technology adoption, promote cleaner combustion, and support emissions monitoring upgrades. Qualified facilities can reduce upgrade costs by 30–70% through these mechanisms, improving regulatory compliance and investment feasibility.

Compliance doesn’t have to be a cost center—funding programs turn it into a cost-saving opportunity.

Clean air and emissions reduction programs can cover 30–70% of emissions control upgrade costs for oil-fired boilers.True

These programs aim to accelerate clean technology adoption and reduce the financial barrier to environmental compliance.

🏛️ Common Funding Sources for Emissions Compliance

| Program Type | Examples | Benefit to Oil-Fired Boiler Users |

|---|---|---|

| Clean Air State Grants | U.S. EPA DERA, NYSERDA, AQMD CA, CARB | Funds for low-NOₓ burners, controls, retrofits |

| Energy Efficiency Rebates | State utility efficiency programs | Upgrades to oxygen trim or control systems |

| Carbon Market Credits | Regional Greenhouse Gas Initiative (RGGI), LCFS | Monetize CO₂ reduction via credit sales |

| Diesel/Combustion Transition Funds | EPA Targeted Airshed Grants, VW Trust | Replacement funding if switching to gas |

| Climate Infrastructure Funds | Inflation Reduction Act (IRA), DOE Office | Major cost-share for decarbonization projects |

📊 Example: Emissions Upgrade Cost Offset Model

| Project Description | Cost (USD) | Offset Program | Funded Portion | Net Cost After Funding |

|---|---|---|---|---|

| Low-NOₓ Burner Installation | $85,000 | State AQMD Clean Air Fund | 60% | $34,000 |

| CEMS Installation & Compliance Reporting | $42,000 | EPA Clean Air Implementation Grant | 50% | $21,000 |

| Boiler Replacement (Oil → Low-NOₓ Gas) | $350,000 | IRA + State Carbon Fund | 40% | $210,000 |

Properly structured applications can cut compliance project costs in half.

💸 Eligible Boiler Upgrades for Funding

| Upgrade Type | Typical Support Level (%) | Notes |

|---|---|---|

| Low-NOₓ Burners | 30–60% | Must meet local BACT or RACT thresholds |

| SCR or SNCR Retrofits | 40–70% | For NOₓ reduction in high-use boilers |

| CEMS & Monitoring Systems | 40–60% | Required for permit tracking |

| Oxygen Trim & Combustion Control | 30–50% | Improves efficiency and reduces CO/NOₓ |

| Fuel Conversion (Oil to Gas) | 30–50% (sometimes more) | Includes piping, burners, controls |

🌍 Notable Regional Clean Air Incentive Programs

| Region | Program Name | Key Benefit for Oil Boilers |

|---|---|---|

| California (SCAQMD) | RECLAIM Buydown, Clean Air Grant Fund | NOₓ burner retrofit and monitoring grants |

| New York (NYSERDA) | Industrial Energy Efficiency Program | Boiler control upgrades and retrofits |

| Texas (TERP) | Emissions Reduction Incentive Grants | Fuel-switch and emissions tech funding |

| Midwest (RGGI States) | CO₂ Allowance Auctions | Offset costs via tradable carbon credits |

| Federal (EPA DERA) | Diesel/Combustion Retrofit Funding | Support for aged boiler phaseouts |

📋 Requirements to Qualify for Clean Air Funding

| Criteria | Required for Most Programs |

|---|---|

| Located in nonattainment or priority zone | ✅ Yes |

| Boiler must be operational pre-project | ✅ Yes |

| Demonstrated NOₓ/PM/CO₂ reduction | ✅ Yes |

| Measurement or M&V post-upgrade | ✅ Yes |

| Use of certified equipment and installers | ✅ Yes |

Funding programs often require documented emissions reductions and post-installation measurement to ensure compliance.True

Programs are performance-based and require transparency to justify public or regulatory subsidies.

✅ Steps to Access Emissions Funding

| Step | Purpose |

|---|---|

| Conduct emissions audit or baseline test | Establish eligibility and impact |

| Identify applicable programs (federal/state) | Tailor application to funding source |

| Gather vendor quotes and project scope | Needed for budget justification |

| Submit pre-approval application | Many programs do not allow retroactive claims |

| Install equipment and submit M&V report | Required for final fund disbursement |

Summary

Emissions compliance doesn’t have to be a financial burden—thanks to clean air incentive programs and emissions reduction funding, many industrial oil-fired boiler upgrades can be partially or even substantially funded through public and regulatory programs. Whether upgrading burners, adding CEMS, or switching to cleaner fuels, these initiatives can reduce project costs by 30–70%, shorten payback periods, and ensure environmental compliance without exhausting capital budgets. In today’s regulatory and financial landscape, clean air isn’t just a mandate—it’s an investment opportunity with backing.

Can Performance Contracts (ESCO Models) Be Used for Oil-Fired Boiler Financing?

Industrial and institutional facilities often hesitate to invest in capital-intensive systems like oil-fired boilers due to the significant upfront cost and uncertain return on investment. In response, Energy Service Companies (ESCOs) offer a solution: performance-based contracts that finance, design, install, and maintain energy systems—including boiler retrofits—while guaranteeing performance outcomes. Known as Energy Performance Contracts (EPCs), this model allows facilities to upgrade to new oil-fired boilers without paying upfront, repaying the investment over time using energy savings generated by the new system.

Yes, performance contracts through ESCO models can be used to finance oil-fired boiler upgrades. Under an Energy Performance Contract (EPC), an ESCO covers the cost of equipment (like high-efficiency oil-fired boilers), installation, and maintenance. The client repays the investment over 5–15 years using guaranteed savings in fuel consumption, maintenance costs, or emissions penalties. If the savings do not materialize as projected, the ESCO absorbs the shortfall—minimizing financial risk for the facility.

Performance contracting turns deferred boiler upgrades into self-funding, guaranteed improvements.

Oil-fired boilers can be financed under ESCO performance contracts where energy savings cover the cost of system upgrades.True

ESCOs commonly support HVAC and boiler efficiency projects through shared-savings or guaranteed-savings agreements.

🔧 How ESCO Performance Contracts Work

| Phase | Description |

|---|---|

| Audit & Feasibility | ESCO evaluates boiler performance, load, and savings |

| Project Proposal | Detailed plan with guaranteed savings & payback |

| Installation & Retrofit | ESCO installs high-efficiency oil-fired boiler |

| Measurement & Verification (M&V) | ESCO monitors actual performance |

| Repayment via Savings | Customer repays from energy/fuel savings |

If savings fall short, the ESCO is responsible for the financial gap.

🧾 Typical Boiler Project Scope Under ESCO Model

| Component | Included in Contract |

|---|---|

| New high-efficiency oil-fired boiler | ✅ Yes |

| Burner upgrade (low-NOₓ or modulating) | ✅ Yes |

| Combustion control systems (O₂ trim) | ✅ Yes |

| Insulation and piping improvement | ✅ Yes |

| CEMS or emissions compliance system | ✅ Optional (if justified) |

| Operator training and O&M service | ✅ Often included |

📊 Example: Performance Contract – 5.5 MMBtu/hr Oil Boiler

| Item | Value (USD) |

|---|---|

| Boiler + Controls Installation | $180,000 |

| Annual Fuel Savings (20%) | $35,000 |

| Annual Maintenance Savings | $5,000 |

| Total Annual Savings | $40,000 |

| Contract Term | 7 years |

| Annual Payment to ESCO | $38,000 (fixed) |

| Net Positive Cash Flow | $2,000/year |

After 7 years, all savings accrue to the facility, with no more debt.

📈 Performance Contracting Models

| Model Type | ESCO Risk | Client Risk | Ownership | Notes |

|---|---|---|---|---|

| Shared Savings | High | Low | Shared or ESCO | Both parties split actual savings |

| Guaranteed Savings | Medium | Low | Client | Client pays fixed fee, ESCO guarantees savings |

| Lease-to-Own | Medium | Medium | Client | Equipment ownership at end of term |

Performance contracts offer guaranteed energy savings that make boiler projects bankable for institutions with limited capital.True

They remove upfront cost barriers and align payment with realized savings, reducing financial exposure.

✅ Ideal Candidates for ESCO Boiler Financing

| Organization Type | Why ESCOs Fit Well |

|---|---|

| Universities and Hospitals | Large loads, long-term planning |

| Public Agencies / Municipalities | Budget constraints, need for efficiency |

| Industrial Plants | Continuous operations, large fuel usage |

| Private Facilities with CapEx Limits | ESCOs offer off-balance sheet options |

📋 Key Contract Considerations

| Clause | Why It Matters |

|---|---|

| Savings Guarantee | Ensures project viability and performance |

| M&V Methodology | Clarifies how savings are measured |

| Term Length | Affects total interest cost and cash flow |

| Early Termination Clause | Avoid unexpected penalties |

| O&M Responsibility | Often included in ESCO scope |

Summary

Performance contracts through ESCO models offer an effective, low-risk pathway for financing oil-fired boiler upgrades, especially when efficiency gains and compliance needs must be addressed without straining capital budgets. With the ESCO assuming performance risk and funding responsibility, facilities can immediately benefit from reduced fuel consumption and improved emissions without upfront costs. As energy regulations tighten and efficiency becomes a financial imperative, performance contracting transforms boiler upgrades into self-financing, performance-verified investments.

What Steps Should Buyers Take to Identify and Apply for Financing and Incentive Programs?

Replacing or upgrading an industrial oil-fired boiler is a strategic investment—one that impacts operational efficiency, emissions compliance, and long-term cost savings. However, such systems come with significant upfront costs and regulatory burdens. Fortunately, businesses can offset these through financing options (loans, leases, ESCOs) and incentive programs (tax deductions, grants, rebates). Yet identifying, qualifying for, and successfully applying to these programs requires a clear, structured approach to avoid missed opportunities or rejected applications.

To identify and apply for financing and incentive programs for oil-fired boilers, buyers should follow a structured process that includes conducting a boiler needs assessment, reviewing available tax and incentive programs (federal, state, and utility), engaging financing or ESCO partners, gathering documentation, and submitting applications before purchase. This ensures eligibility, maximizes financial support, and reduces project risk. Many programs require pre-approval, documented energy savings, and use of qualified equipment and installers.

The right steps at the start can cut capital costs and maximize ROI before a single gallon of oil is burned.

Most energy efficiency incentives and tax benefits for boiler projects require pre-application approval and proper documentation to qualify.True

These programs are performance-based and require verification to protect public or utility funds.

✅ Step-by-Step Guide: How to Identify and Apply for Boiler Financing & Incentives

Step 1: Conduct a Boiler Needs & Savings Assessment

| Action | Why It Matters |

|---|---|

| Perform a technical audit | Identifies size, efficiency loss, and replacement value |

| Estimate fuel and maintenance savings | Required for ROI and payback modeling |

| Determine emissions compliance needs | Aligns upgrade with regional air quality goals |

A third-party energy audit strengthens your funding and loan applications.

Step 2: Research and List Available Programs

| Resource | What to Look For |

|---|---|

| Federal Tax Codes (Section 179, 179D) | Immediate deductions or accelerated depreciation |

| State Energy Agencies (e.g. NYSERDA, CA AQMD) | Rebates and grant funding |

| Utility Programs (e.g. Mass Save, PG&E) | Prescriptive or custom boiler incentives |

| Federal Clean Air Grants (e.g. EPA DERA) | Emissions upgrade or replacement assistance |

| ESCOs and Financial Institutions | Performance-based financing or low-interest loans |

Use tools like DSIRE to search incentives by ZIP code and technology.

Step 3: Match Boiler Equipment to Program Requirements

| Qualification Criteria | Example for Oil-Fired Boilers |

|---|---|

| Efficiency threshold (e.g. >85% thermal) | Required for most utility rebates |

| Low-NOₓ or emissions certified equipment | Needed for air quality funding |

| ENERGY STAR / listed product directory | Often preferred or required by grant programs |

| Installation by qualified contractors | May be mandated by utility or government agencies |

Incentive programs typically require that boilers meet minimum efficiency and emissions performance levels.True

This ensures that only projects with real environmental benefit receive public support.

Step 4: Explore Financing Options

| Option | Key Features |

|---|---|

| Equipment Loan | Retain ownership, amortized repayment |

| Operating Lease | Off-balance sheet, tax-deductible payments |

| ESCO Performance Contract | No upfront cost, paid from savings |

| Vendor Financing | Deferred or staged payments from manufacturer |

Evaluate the total cost, interest rate, and ownership rights of each.

Step 5: Gather Application Documentation

| Typical Requirements | Details |

|---|---|

| Audit or feasibility study report | Shows energy/emissions baseline |

| Equipment quote and performance specs | Includes efficiency, emissions data |

| Project timeline and contractor info | Confirms installation timeline |

| Corporate tax ID and W-9 form (US) | Needed for grant or rebate disbursement |

| Utility bills or fuel consumption logs | For savings verification post-installation |

Step 6: Submit Applications Before Purchase

| Program Type | Deadline Advice |

|---|---|

| Federal tax deductions | File during your tax year |

| Rebate/utility programs | Pre-approval required in most cases |

| Clean air grant programs | Apply during annual or quarterly cycles |

| ESCO contracts | Typically structured and executed pre-install |

Retroactive funding is rare. Submit before contract execution to remain eligible.

Step 7: Complete Project & Submit Verification

| Task | Required for Final Payment |

|---|---|

| Installation certification | Often requires sign-off by utility rep |

| Post-project inspection or testing | Verifies emissions or efficiency targets |

| Final invoice & payment documentation | Closes out funding or lease paperwork |

Funding and rebate programs typically require post-installation verification of performance or energy savings.True

This ensures that public funds are used effectively and the installed equipment meets promised benchmarks.

Summary

Upgrading an oil-fired boiler is a major decision—but it doesn’t have to be a financial burden if approached strategically. By conducting a technical audit, researching all applicable incentive programs, and aligning your project with financing and regulatory requirements, you can secure substantial funding and minimize out-of-pocket costs. Most importantly, apply before you buy, meet performance specs, and document your success. With the right preparation, today’s energy-efficient boiler could become tomorrow’s smartest financial move—funded not just by you, but by the incentives designed to help you upgrade.

🔍 Conclusion

Industrial oil-fired boiler projects don’t need to rely on capital funding alone. From government subsidies and energy grants to vendor financing and tax-based incentives, there are multiple ways to reduce upfront costs and accelerate ROI. By exploring these options early in the procurement process, businesses can secure cost-effective, compliant, and future-ready thermal systems without straining their capital budgets.

📞 Contact Us

💡 Need help exploring your financing or incentive options? Our team offers procurement consulting, energy grant support, and project ROI analysis for oil-fired boiler installations and upgrades.

🔹 Let us help you reduce boiler investment costs and access the financial tools that power smarter energy decisions! 🛢️💰📄

FAQ

What financing options are available for industrial oil-fired boilers?

Common financing options include:

Capital equipment loans from banks or financial institutions

Lease-to-own agreements (equipment leasing with end-of-term buyout)

Energy performance contracts (EPCs) through third-party energy service companies (ESCOs)

Vendor or manufacturer financing, often at reduced interest rates

These options help spread out the cost over time, preserving cash flow and making budgeting predictable.

Are there federal or state incentives for oil-fired boiler installations?

While oil-fired systems are less commonly incentivized than renewable or high-efficiency technologies, some programs may still apply:

U.S. Section 179 Tax Deduction allows accelerated depreciation of capital equipment

Local clean air grants or industrial modernization funds (state-dependent)

Low-interest energy efficiency loan programs offered by utilities or state energy offices

Can oil-fired boilers qualify for emissions-reduction funding?

Yes, if the boiler includes low-NOx burners, high-efficiency heat exchangers, or advanced emissions control systems, it may qualify for:

Air quality improvement credits

Rebates for fuel-switching (e.g., from older coal systems)

Environmental grant programs that support emissions reduction in industrial sectors

What private sector incentives exist for boiler upgrades?

Some utility companies and energy cooperatives offer:

Custom rebate programs for high-efficiency boiler upgrades

Incentives for demand-side energy management

Special rates or fuel purchase agreements tied to efficiency benchmarks

How can businesses identify relevant incentives for their region?

Use the Database of State Incentives for Renewables & Efficiency (DSIRE) – https://www.dsireusa.org

Contact local utility providers or state energy departments

Work with boiler manufacturers or energy consultants, who often assist with paperwork and eligibility verification

References

DSIRE – Incentives Database for U.S. Industrial Projects – https://www.dsireusa.org

Section 179 Tax Deduction Guidelines – https://www.section179.org

U.S. Department of Energy Financing Options – https://www.energy.gov

EPA Clean Air Technology Incentives – https://www.epa.gov

Energy Performance Contracting Explained – IEA – https://www.iea.org

Equipment Leasing Benefits for Industrial Projects – https://www.nalhfa.org

ESCO Boiler Upgrade Case Studies – https://www.naesco.org

State Energy Office Programs – https://www.naseo.org

Industrial Efficiency Loan Programs – https://www.energytrust.org

Utility Energy Efficiency Rebates – https://www.energystar.gov