Industrial biomass boilers are increasingly adopted as a renewable, carbon-neutral alternative to fossil fuel-based systems. But while they offer long-term environmental and potential fuel cost advantages, biomass boilers also involve complex logistics, maintenance demands, and variable fuel quality. Relying on upfront pricing alone can misrepresent the total cost. A thorough Lifecycle Cost Analysis (LCCA) provides a clear financial roadmap for evaluating the true economic and operational value of a biomass boiler investment.

To perform a lifecycle cost analysis (LCCA) for an industrial biomass boiler, you must calculate all associated costs over the boiler’s lifespan—including initial capital expenditure (CAPEX), fuel supply and transport, maintenance, downtime, emissions compliance, ash disposal, labor, and end-of-life replacement. This data helps determine the Total Cost of Ownership (TCO), Net Present Value (NPV), and Return on Investment (ROI). Accurate LCCA supports informed decision-making and sustainable budgeting.

Below is a structured guide for conducting a reliable and comprehensive LCCA for biomass boiler systems.

What Is Lifecycle Cost Analysis (LCCA) and Why Is It Essential for Biomass Boilers?

Biomass boilers are increasingly popular for industrial energy generation due to their renewable fuel source and carbon neutrality. But unlike conventional boilers, their fuel handling complexity, moisture sensitivity, and ash generation introduce unique cost dynamics. Decisions based only on purchase price ignore the substantial long-term costs of fuel logistics, maintenance, emissions compliance, and operational labor. That’s where Lifecycle Cost Analysis (LCCA) becomes essential. It provides a full-scope view of what it truly costs to own and operate a biomass boiler over 20–30 years, enabling informed investment decisions that align with both financial and sustainability goals.

Lifecycle Cost Analysis (LCCA) is a financial modeling method that calculates the total cost of owning and operating a biomass boiler throughout its service life—including capital expenditures (CAPEX), fuel and transport, maintenance, ash handling, emissions compliance, water treatment, labor, downtime, and decommissioning. It is essential for biomass boilers due to their complex logistics, variable fuel quality, and higher O&M intensity compared to fossil fuel systems. LCCA helps organizations make smart, future-proof decisions by identifying the most cost-effective and sustainable solutions over decades—not just at the point of purchase.

In biomass projects, upfront savings can be dwarfed by long-term fuel and maintenance burdens.

Lifecycle cost analysis reveals the full long-term economic impact of biomass boiler systems, far beyond the purchase price.True

Biomass boilers have complex O&M requirements that make lifecycle evaluation essential for cost-effective investment.

📦 What’s Included in Lifecycle Cost Analysis for Biomass Boilers?

| Cost Category | Description |

|---|---|

| CAPEX | Boiler, fuel feed system, ash handling, controls |

| Fuel & Delivery | Biomass cost per ton + trucking, drying, storage |

| Ash Handling | Bottom/fly ash removal, disposal, or reuse |

| Maintenance & Repairs | Refractory, grate, screw feeders, tubes, fans |

| Water & Chemicals | Softening, pH balancing, anti-foaming agents |

| Labor & Monitoring | Operator shifts, fuel loader, instrumentation checks |

| Emissions Compliance | Cyclone, ESP, bag filter, CEMS, CO₂ offset management |

| Downtime & Lost Output | Forced outages, seasonal fuel variability |

| Decommissioning | Asset removal and site restoration |

LCCA gives you a full picture of system performance and cost stability.

🧮 Example: LCCA for a 5 MW Biomass Boiler Over 20 Years

| Cost Element | Estimate (USD) |

|---|---|

| CAPEX (turnkey installation) | $4.5 million |

| Fuel & Logistics (15,000 tons/year @ $60 avg) | $18 million |

| Maintenance & Parts | $1.6 million |

| Labor (staffing, training) | $1.2 million |

| Ash Handling & Disposal | $500,000 |

| Water Treatment & Chemicals | $350,000 |

| Emissions Equipment & O&M | $900,000 |

| Downtime & Performance Losses | $400,000 |

| Decommissioning (EOL) | $250,000 |

| Total Lifecycle Cost (20 Years) | ~$27.7 million |

Fuel + maintenance = 70–80% of TCO, making them key cost drivers.

📊 Why LCCA Is Essential for Biomass Systems

| Challenge | How LCCA Helps |

|---|---|

| Fuel variability (moisture, ash) | Projects real combustion efficiency impact |

| Ash volume & handling costs | Includes frequency and disposal fees |

| High O&M intensity | Captures repair cycles for moving parts |

| Emissions compliance (PM, NOₓ) | Forecasts filter maintenance, reporting |

| Carbon credit benefits or penalties | Models credits, offsets, or regulatory risks |

| Load fluctuation sensitivity | Includes part-load inefficiency |

Without LCCA, a biomass boiler that looks cheap may become the most expensive to own.

📈 Side-by-Side Example: Standard vs. Optimized Biomass Boiler

| Metric | Standard Boiler | High-Efficiency Boiler |

|---|---|---|

| CAPEX | $4.2M | $4.8M |

| Efficiency (Net) | 72% | 83% |

| Fuel Use (tons/year) | 15,000 | 12,900 |

| Annual Fuel Cost | $900,000 | $774,000 |

| Maintenance + Ash Costs | $135,000/year | $115,000/year |

| TCO (20 years) | $27.5M | $24.3M |

| ROI vs. Standard | — | 13.1% annualized |

| Payback (Extra $600K CAPEX) | — | ~5.2 years |

Investing in a more efficient biomass boiler pays back within 5–7 years through reduced fuel and maintenance costs.True

Better combustion and ash management reduce operating costs significantly over the system's lifecycle.

🧾 Best Practices for Biomass LCCA

| Strategy | Benefit |

|---|---|

| Model real fuel moisture scenarios | Adjusts combustion efficiency, drying costs |

| Include load profiles (not full-load only) | Reveals part-load inefficiencies |

| Include inflation and fuel escalation | More realistic future projections |

| Account for ash content by fuel type | Prevents disposal cost underestimation |

| Consult operators for failure cycles | Reflects real repair intervals and costs |

LCCA is most powerful when combining financial modeling with technical field data.

Summary

Lifecycle Cost Analysis (LCCA) is not just useful—it’s essential when investing in a biomass boiler system. While biomass offers renewable, low-carbon heat, it also introduces unique challenges like fuel variability, ash production, and high maintenance needs. A smart buyer looks beyond CAPEX to see 20–30 years of real operating conditions and costs. LCCA reveals which system will serve you best—not just in the first year, but across its entire lifecycle. In the world of biomass boilers, the cheapest option upfront is rarely the most economical in the long run.

What Upfront Costs Should Be Included in the Biomass Boiler Investment Plan?

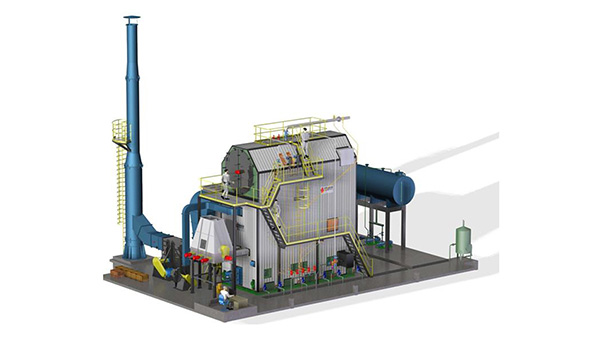

Investing in a biomass boiler requires more than just buying a combustion unit. Biomass systems are mechanically complex and fuel-handling intensive, requiring multiple auxiliary systems and civil infrastructure to support continuous, safe, and compliant operation. Many first-time investors make the mistake of budgeting for the boiler alone—only to discover that essential components like fuel storage, feed conveyors, emissions controls, and automation can double or triple the total installed cost. A comprehensive investment plan must include all related systems, installation labor, permits, and commissioning services to provide a realistic picture of capital requirements.

The upfront costs in a biomass boiler investment plan must include the boiler unit, fuel reception and handling system, combustion and control equipment, flue gas treatment, water treatment, ash handling, electrical integration, site preparation, labor, and compliance-related permits. These capital expenditures (CAPEX) typically range from $1.2 million to over $8 million depending on boiler capacity, fuel type, automation level, and regulatory environment. A full-scope plan avoids budgeting shortfalls and ensures a smooth path to commissioning and operation.

Your boiler won’t run without fuel, controls, and permits—so your budget shouldn’t either.

The total installed cost of a biomass boiler system is typically 2 to 4 times the cost of the boiler unit alone.True

Auxiliary systems such as fuel conveyors, emissions controls, and civil works significantly increase capital requirements.

📦 Full Breakdown of Biomass Boiler Upfront Capital Costs

| Capital Category | Description | Typical Share of CAPEX |

|---|---|---|

| Boiler Unit | Combustion chamber, furnace, pressure vessel | 25–35% |

| Fuel Storage & Feeding System | Silos, hoppers, conveyors, rotary valves, shredders | 15–20% |

| Combustion Air & Draft Equipment | FD/ID fans, air preheater, ducting, dampers | 5–10% |

| Ash Handling System | Bottom/fly ash conveyors, hoppers, storage bins | 5–10% |

| Control & Instrumentation | PLC/SCADA, temperature/pressure sensors, safety alarms | 5–10% |

| Emissions Control Equipment | Cyclone, bag filter, ESP, scrubber, CEMS | 10–15% |

| Feedwater & Blowdown Systems | Pumps, softeners, condensate tank, deaerator | 5–8% |

| Electrical & Panel Integration | Power supply, MCCs, lighting, grounding | 3–7% |

| Installation Labor | Piping, rigging, welding, insulation | 10–15% |

| Civil Works & Site Prep | Concrete foundations, structural platforms, access roads | 5–10% |

| Permits & Code Compliance | Environmental, fire, emissions, safety inspections | 1–3% |

Each category is critical to achieving turnkey readiness and ensuring safe, legal operation.

🧪 Example: 5 MW Biomass Boiler (20 TPH Steam Capacity)

| Cost Element | Estimated Cost (USD) |

|---|---|

| Boiler Unit | $1,200,000 |

| Fuel Storage & Feed System | $850,000 |

| Combustion Air & Fan System | $400,000 |

| Ash Removal Equipment | $450,000 |

| Controls (PLC + Safety Sensors) | $380,000 |

| Emissions Control (Cyclone + ESP) | $600,000 |

| Feedwater + Blowdown | $300,000 |

| Electrical Panels + Wiring | $250,000 |

| Site Prep & Civil Works | $400,000 |

| Installation & Labor | $700,000 |

| Permits & Engineering Services | $100,000 |

| Total Installed CAPEX | ~$5.63 million |

Skipping ash or emissions systems would violate permits—and eventually cost more in retrofits or fines.

📊 CAPEX Sensitivity by Boiler Size

| Boiler Size | Installed Cost Range (USD) | Key Drivers |

|---|---|---|

| 2 TPH (Small plant) | $1.2M – $2.5M | Basic feed + minimal emissions control |

| 5 TPH (Mid-size) | $2.5M – $4.5M | Needs advanced ash & emissions systems |

| 10–20 TPH (Large) | $5M – $8M+ | Full automation + integrated feed & recycling |

Higher capacity also scales up infrastructure, not just boiler steel.

📋 Factors That Influence Upfront Cost

| Factor | Cost Impact |

|---|---|

| Fuel Type (chips vs. pellets vs. agri-waste) | Changes feed system complexity |

| Moisture Content | Affects drying needs or furnace size |

| Ash Content | Increases removal and disposal systems |

| Emissions Regulations | More controls = higher cost |

| Automation & Controls | Higher capex, better O&M savings |

| Site Accessibility | Remote/complex sites = more civil works |

Fuel choice alone can shift costs by 20–30%, due to handling and emissions differences.

Summary

A biomass boiler investment must budget for much more than just the boiler unit. Upfront costs should comprehensively include fuel handling systems, combustion support, emissions control, ash removal, automation, electrical, site work, and compliance. These capital elements are essential for safe, legal, and continuous operation—and they often represent more than half the total project cost. For realistic planning, budget with a total installed view, not a unit price mindset. In biomass systems, you don’t just install a boiler—you build an ecosystem.

How Do Fuel Logistics, Moisture Content, and Sourcing Affect Long-Term Fuel Costs?

Biomass boilers offer sustainable heat and power with reduced emissions—but their long-term economic performance is tightly linked to fuel quality, transportation logistics, and sourcing strategies. Unlike standardized fossil fuels, biomass fuel comes in many forms—wood chips, pellets, agricultural residues—each with unique handling, moisture, ash, and energy characteristics. Over the boiler’s lifetime, small variations in fuel type, moisture content, or supply chain structure can cause massive differences in fuel costs, combustion efficiency, maintenance frequency, and overall plant economics. Understanding these variables is essential for budgeting, procurement, and lifecycle cost analysis (LCCA).

Fuel logistics, moisture content, and sourcing critically affect long-term biomass fuel costs by influencing fuel price per ton, energy value per MMBtu, handling requirements, and combustion efficiency. Wet fuels cost more to burn due to lower calorific value, while long-distance transport increases unit fuel cost. Unreliable sourcing can lead to price volatility or shortages. Over 20–30 years, these variables significantly impact total cost of ownership and must be optimized to ensure fuel cost stability, plant reliability, and environmental compliance.

If you don’t manage your fuel variables, your costs will manage you.

Moisture content, fuel transport distance, and supplier reliability are the biggest variables affecting long-term biomass fuel cost.True

These factors determine how much energy you actually receive and what you pay per useful MMBtu.

📦 Key Biomass Fuel Cost Components

| Component | Description | Cost Influence |

|---|---|---|

| Fuel Purchase Price (FOB) | Base cost per ton (fresh weight or dry basis) | Moderate |

| Moisture Content (%) | Affects net energy content and boiler efficiency | High |

| Transport Distance & Mode | Affects $/ton delivered (road, rail, ship) | High |

| Supplier Reliability | Impacts security of supply, price stability | High |

| Fuel Consistency | Affects combustion control and ash production | Moderate |

| Handling Requirements | Chipping, drying, conveying | Moderate |

🔢 Fuel Moisture and Energy Value Comparison

| Fuel Type | Moisture (%) | LHV (kcal/kg) | LHV (MMBtu/ton) | Combustion Efficiency Impact |

|---|---|---|---|---|

| Wood Pellets | 8–12% | 4,200–4,500 | ~17.6 | High |

| Dry Wood Chips | 15–25% | 3,500–4,000 | ~15.1 | Moderate |

| Green/Wet Chips | 35–50% | 2,200–2,700 | ~11.5 | Low (requires drying) |

| Agricultural Waste | 15–30% | 3,000–3,800 | ~14.3 | Varies |

Wet fuels require more per ton to deliver the same thermal output—up to 30–40% more tons/year.

📊 Fuel Cost Impact: Moisture vs. Energy Value

| Fuel Type | Delivered Cost ($/ton) | Moisture (%) | Net Energy (MMBtu/ton) | Cost per MMBtu ($) |

|---|---|---|---|---|

| Wood Pellets | $130 | 10% | 17.5 | $7.43 |

| Dry Wood Chips | $85 | 20% | 15.0 | $5.66 |

| Wet Chips (Green) | $65 | 45% | 11.5 | $5.65 |

Wet fuel seems cheaper per ton, but once adjusted for usable energy, it’s often more expensive per MMBtu.

🚛 Fuel Logistics: Transport & Handling Cost Factors

| Distance (km) | Transport Mode | Cost Add-on ($/ton) |

|---|---|---|

| <50 km | Truck | $5 – $15 |

| 50–200 km | Truck/Trailer | $15 – $35 |

| 200–800 km | Rail or Barge | $20 – $45 |

| >800 km | Intermodal/Ship | $40 – $80 |

Proximity to biomass source can save $10–40/ton, or hundreds of thousands per year.

🧪 Long-Term Cost Case: 10 TPH Biomass Boiler (Fuel 15,000 tons/year)

| Scenario | Fuel Type | Moisture | Price/ton | Fuel Cost/Year | Fuel MMBtu/Year | Cost/MMBtu |

|---|---|---|---|---|---|---|

| Case 1: Local Dry Chips | Dry Chips | 20% | $90 | $1.35M | 225,000 | $6.00 |

| Case 2: Wet Chips, Distant Source | Wet Chips | 45% | $70 + $25 | $1.425M | 172,500 | $8.26 |

| Case 3: Premium Pellets | Wood Pellets | 10% | $130 | $1.95M | 262,500 | $7.43 |

Efficient fuel + short transport = lowest lifecycle fuel cost, even with higher $/ton purchase price.

📋 Sourcing Strategy Matters

| Sourcing Approach | Benefits | Risks |

|---|---|---|

| Long-Term Fixed Contract | Price stability, supply security | May miss market drops |

| Local Cooperative Supply | Community support, short haul | May lack consistency |

| Spot Market (Seasonal) | Flexible pricing | High volatility |

| Own Biomass Plantation | Fuel control, low cost | High upfront investment |

Best practice: blend 2–3 sources for price stability and reliability.

Summary

Long-term biomass boiler fuel costs are far more complex than $/ton headlines suggest. Moisture content, transport logistics, and sourcing strategy fundamentally shape the true cost per MMBtu delivered to your furnace. Wet, distant, or inconsistent fuels may appear cheaper but often result in higher operating costs, lower combustion efficiency, and more ash-related maintenance. Accurate budgeting and fuel contracting must be based on energy content, not just bulk tonnage. In biomass fuel economics, what matters most isn’t what you pay per ton—it’s what you get per BTU.

What Are the Operational and Maintenance Costs, Including Ash Handling and Cleaning, for Industrial Biomass Boilers?

Biomass boilers provide a renewable and eco-friendly way to generate steam and power, but they are mechanically intensive systems that require ongoing operational vigilance and regular maintenance. Unlike gas or oil-fired systems, biomass combustion produces large volumes of ash, introduces variable fuel residues, and requires frequent cleaning to maintain heat transfer efficiency. All of these factors contribute to recurring operational and maintenance (O&M) costs, which are a major component of total cost of ownership (TCO). Ignoring or underestimating them leads to performance decline, unplanned shutdowns, and soaring repair bills.

Operational and maintenance costs for industrial biomass boilers typically range from 2.5% to 5.5% of the total installed capital cost per year, including ash handling, soot cleaning, equipment inspection, refractory maintenance, and labor. Key cost contributors include ash removal systems, scheduled shutdown overhauls, fan and screw wear, and biomass-specific deposits. Ash handling alone can cost $3 to $10 per ton of fuel burned, depending on ash content and disposal strategy. Over a 20–30 year life, O&M costs represent millions in recurring expenses, requiring proactive planning and budgeting.

A biomass boiler can’t run clean or efficiently without hands-on, routine care.

Operational and maintenance costs are significantly higher in biomass boilers than gas systems due to ash generation and fuel variability.True

Frequent cleaning, wear on feeding and ash systems, and emissions management add to recurring cost.

📦 Typical O&M Activities and Cost Categories

| Category | Activity Description | Frequency | Cost Range (USD/year) |

|---|---|---|---|

| Ash Handling | Bottom ash removal, fly ash silo discharge, disposal | Daily – Weekly | $30,000 – $100,000 |

| Soot Blowing & Tube Cleaning | Removes fouling from heat exchanger surfaces | Weekly – Monthly | $10,000 – $25,000 |

| Refractory Repair | Furnace floor, wall re-lining, crack repair | Annually | $10,000 – $50,000 |

| Grate & Screw Maintenance | Wear parts inspection and replacement (grate bars, conveyors) | Quarterly – Annually | $20,000 – $60,000 |

| Fan Bearings & Lubrication | ID/FD fan and motor service | Semi-annually | $5,000 – $10,000 |

| PLC & Instrument Calibration | Thermocouples, pressure switches, O₂ trim | Annually | $3,000 – $8,000 |

| Operator Labor | Shifts, fuel loading, ash clearing | Continuous | $60,000 – $120,000 |

| Emissions Filter Replacement | Baghouse bags or ESP electrodes | Every 2–4 years | $30,000 – $90,000 |

These costs vary based on boiler size, fuel type, runtime, and automation level.

🔧 O&M Cost Estimates by Boiler Size

| Boiler Size (Steam Output) | Annual O&M Cost (USD) | Key Drivers |

|---|---|---|

| 2–5 TPH | $75,000 – $150,000 | Basic ash & manual fuel feed |

| 10 TPH | $150,000 – $300,000 | Automated feed, wet fuel, baghouse |

| 20–30 TPH | $300,000 – $600,000 | Multi-operator system, advanced controls |

O&M is 20–30% higher for fuels with high ash, moisture, or inconsistent form (e.g., agri-waste).

📊 Ash Generation and Handling Cost

| Fuel Type | Ash Content (%) | Ash from 10,000 tons (tons) | Handling Cost @ $7/ton | Disposal Cost (Landfill) |

|---|---|---|---|---|

| Wood Pellets | 0.5–1.0% | 50–100 | $350 – $700 | Often reusable |

| Wood Chips | 1–2% | 100–200 | $700 – $1,400 | Moderate |

| Straw/Agri-Waste | 3–8% | 300–800 | $2,100 – $5,600 | High (landfill fees apply) |

High-ash fuels increase handling time, disposal volume, and compliance reporting.

🧪 Example: 10 TPH Biomass Boiler, 8,000 hrs/year

| Item | Unit Cost | Annual Quantity | Annual Cost (USD) |

|---|---|---|---|

| Fuel Used | $80/ton | 15,000 tons | $1.2 million |

| Ash Produced | $7/ton handling | 300 tons | $2,100 |

| Tube Cleaning & Soot Blowing | Fixed | — | $20,000 |

| Maintenance Parts | Avg | — | $50,000 |

| Operator Labor | $80,000/year | — | $80,000 |

| Water Treatment | $8,000/year | — | $8,000 |

| Controls & Sensors | Annual Calibration | — | $5,000 |

| Total Annual O&M | — | — | ~$165,100 |

Over 20 years: $3.3–3.6 million in O&M—equal to or exceeding boiler CAPEX.

📋 Ways to Control O&M and Ash Costs

| Optimization Method | Benefit |

|---|---|

| Choose low-ash biomass | Reduces disposal cost and fouling |

| Automate ash handling | Saves labor, reduces emissions risk |

| Install soot blower system | Minimizes manual cleaning |

| Use predictive maintenance tools | Prevents forced shutdowns |

| Recycle ash in agriculture/cement | Lowers disposal cost and generates revenue |

Automated ash handling and soot cleaning reduce manual labor cost by up to 30%.True

These systems free operators and prevent performance loss from delayed cleaning.

Summary

Operational and maintenance costs for industrial biomass boilers are significant and continuous, especially due to ash handling, soot cleaning, refractory upkeep, and labor-intensive feeding systems. Depending on fuel type and boiler size, annual O&M costs can range from $100,000 to $600,000 or more, representing a major share of the system’s lifecycle cost. Smart planning, automation, and fuel selection are essential to keep these costs under control. In biomass plants, reliability isn’t just engineered—it’s maintained—every day.

How Should You Calculate Emissions Compliance, Monitoring, and Labor Costs Over Time?

Biomass boilers are recognized for their renewable credentials—but like all combustion systems, they emit pollutants that are regulated by local, national, and international authorities. These include particulate matter (PM), nitrogen oxides (NOₓ), carbon monoxide (CO), volatile organic compounds (VOCs), and carbon dioxide (CO₂). Compliance with these emissions regulations is not optional; it involves capital investment, continuous monitoring, reporting, and skilled labor. Failing to calculate and manage these costs over time can lead to permits delays, fines, retrofitting expenses, or forced shutdowns.

To calculate emissions compliance, monitoring, and labor costs over time for a biomass boiler, you must include capital investment in emissions control equipment (e.g., baghouses, ESPs, scrubbers), annual operation and maintenance (O&M) of those systems, emissions testing and reporting, labor for oversight and documentation, and potential carbon tax or offset fees. These costs can reach 10–15% of total operating costs in some jurisdictions and typically increase with tightening environmental regulations.

Compliance is not just a one-time cost—it’s a long-term financial obligation tied to your boiler’s operating license.

Emissions compliance and monitoring costs for biomass boilers often exceed 10% of total operational expenditure over the boiler's lifecycle.True

They include equipment maintenance, testing, reporting, and potential carbon-related costs, which increase with regulation.

📦 Components of Emissions Compliance Cost

| Category | Description | Frequency/Type |

|---|---|---|

| Control Equipment CAPEX | Baghouse, ESP, cyclone, scrubber, CEMS | One-time + upgrades |

| Control Equipment O&M | Filter replacement, airlock service, duct cleaning | Ongoing |

| Emissions Testing | Stack sampling, lab analysis (NOₓ, PM, CO) | Annual or biannual |

| Monitoring & Reporting | Continuous Emissions Monitoring Systems (CEMS) calibration | Continuous + monthly |

| Labor for Compliance | Environmental engineer/operator time | Weekly/monthly |

| Permit Fees & Renewals | Air emissions permits, renewals, inspections | Annual or multi-year |

| Carbon Tax or Offset Fees | Per-ton CO₂ equivalent (depending on jurisdiction) | Annual (per ton CO₂) |

These costs are spread across equipment, operations, and staffing, not just capital.

🧮 Example: 10 TPH Biomass Boiler – 20-Year Emissions Compliance Model

| Cost Element | Unit Cost (USD) | Frequency/Total | 20-Year Total (USD) |

|---|---|---|---|

| Baghouse & Ducting CAPEX | $600,000 | One-time | $600,000 |

| Bag Replacement (every 4 years) | $60,000 | 5× over 20 years | $300,000 |

| CEMS Purchase + Setup | $100,000 | One-time | $100,000 |

| CEMS O&M and Calibration | $8,000/year | 20 years | $160,000 |

| Annual Stack Testing + Reporting | $4,000/year | 20 years | $80,000 |

| Emissions Engineer Labor | $25/hour × 12 hrs/month | 20 years | ~$72,000 |

| Air Permit Renewals | $3,000 every 3 years | 7 renewals | $21,000 |

| Carbon Offset or Tax (optional) | $20/ton CO₂ × 3,000 tons/year | 20 years | $1.2 million |

| Total Compliance & Monitoring Cost | ~$2.5–2.7 million |

With carbon taxes, emissions costs can surpass $3 million over two decades.

📊 Breakdown of Annual Emissions Compliance Cost

| Item | Cost Estimate (USD/year) |

|---|---|

| Baghouse Maintenance & Spare Parts | $15,000 – $25,000 |

| Stack Testing & Reporting | $3,000 – $5,000 |

| CEMS Calibration & Service | $8,000 – $10,000 |

| Labor (in-house or contractor) | $3,500 – $6,000 |

| Permit Fees, Renewal Applications | $1,000 – $2,500 |

| Total Annual Cost | ~$30,000 – $50,000 |

Jurisdictions with aggressive air quality targets may require real-time uploads, increasing cost further.

📋 Emissions Control Equipment Lifespan

| Equipment | Expected Life | Replacement Cost (USD) |

|---|---|---|

| Bag Filter House | 15–20 years | $500,000 – $1,000,000 |

| ESP (Electrostatic Precipitator) | 20–25 years | $800,000 – $1.2 million |

| Cyclone Separator | 10–15 years | $150,000 – $300,000 |

| CEMS Hardware & Software | 8–12 years | $80,000 – $120,000 |

Budgeting for mid-life system replacement is part of responsible lifecycle planning.

📈 Carbon Pricing Impact Forecast

| Scenario | Price/Ton CO₂ | CO₂ Emitted (tons/year) | Annual Cost | 20-Year Cost |

|---|---|---|---|---|

| Conservative Policy | $20 | 3,000 | $60,000 | $1.2 million |

| Aggressive Policy | $50 | 3,000 | $150,000 | $3.0 million |

| ETS (Emissions Trading System) | Variable ($30–90 avg) | 3,000 | $90,000–270,000 | $1.8M–5.4M |

Carbon cost volatility must be modeled in all long-term planning.

Summary

Calculating emissions compliance, monitoring, and labor costs over time is essential for any industrial biomass boiler investment. These costs span capital equipment, testing services, control system maintenance, and environmental staffing, and they grow over time with tightening regulations and carbon pricing policies. For mid- to large-scale systems, total emissions-related costs can exceed $2.5–$3 million over 20 years, or more with carbon taxes. Proactive planning ensures you avoid fines, protect your operating license, and maintain community and regulatory trust. In modern biomass energy, staying clean means staying compliant—and financially prepared.

How Do You Estimate Payback Period, TCO, and NPV to Evaluate Financial Feasibility?

Industrial biomass boilers offer long-term energy savings and emissions benefits, but their financial feasibility can’t be judged by purchase price alone. Due to their higher upfront cost, complex fuel handling, and emissions control requirements, it’s essential to assess the complete economic picture using financial evaluation tools like payback period, total cost of ownership (TCO), and net present value (NPV). These metrics allow you to compare biomass with other heating options, evaluate competing biomass technologies, and make investment decisions based on long-term returns—not just year-one budgets.

To evaluate the financial feasibility of an industrial biomass boiler, estimate the payback period (the time it takes to recover your investment through savings), TCO (the total cost to own and operate the boiler over its lifetime), and NPV (the present-day value of future savings minus future costs). These metrics require inputs such as capital costs, fuel price savings, operational expenses, lifespan, and discount rates. Together, they reveal whether a biomass boiler will deliver positive returns compared to fossil systems or other renewables.

Don’t let the initial price cloud your judgment—let the long-term math speak for itself.

TCO, payback period, and NPV are essential financial metrics for evaluating biomass boiler investments.True

They show the full financial picture by including savings, fuel costs, and long-term operational impacts.

🔢 1. Payback Period Formula & Example

✅ Formula:

Payback Period = Extra Investment / Annual Net Savings

📊 Example:

| Comparison | Fossil Fuel Boiler | Biomass Boiler |

|---|---|---|

| CAPEX | $900,000 | $1,600,000 |

| Fuel Cost/Year | $1,050,000 | $750,000 |

| Annual Savings | — | $300,000 |

| Extra Investment | — | $700,000 |

Payback = $700,000 / $300,000 = **2.33 years**

Any payback under 5 years is considered excellent for 20–30 year assets.

📦 2. TCO – Total Cost of Ownership

✅ Formula:

TCO = CAPEX + ∑(Fuel + O&M + Labor + Ash Handling + Emissions + Decommissioning)

| Cost Element | 20-Year Estimate (USD) |

|---|---|

| CAPEX | $1.6 million |

| Biomass Fuel (15,000 tons/year @ $75 avg) | $22.5 million |

| O&M, Labor, Cleaning | $4.2 million |

| Ash & Emissions Handling | $900,000 |

| Decommissioning | $200,000 |

| TCO (20 Years) | ~$29.4 million |

Compare with gas boiler TCO: $34–38 million (mostly from high fuel cost).

💰 3. NPV – Net Present Value

✅ Formula:

NPV = (Total Savings – Total Costs) discounted to present using:

NPV = ∑ (Cash Flow in Year t) / (1 + r)^t

Where:

r = discount rate (typically 5–8%)

t = year

Cash flow = Fuel savings – O&M difference

📊 NPV Example:

Savings = $300,000/year

Extra CAPEX = $700,000

O&M difference = $20,000/year higher for biomass

Discount Rate: 6%

Time: 20 years

Net Annual Benefit = $280,000

NPV = ∑ ($280,000 / (1.06)^t), t = 1 to 20

= ~$3.2 million

A positive NPV indicates the project earns more than its cost, after adjusting for time and interest.

📈 Side-by-Side Financial Metric Comparison

| Metric | Biomass Boiler | Fossil Fuel Boiler |

|---|---|---|

| CAPEX | $1.6 million | $900,000 |

| Annual Fuel Cost | $750,000 | $1,050,000 |

| Annual O&M Cost | $200,000 | $140,000 |

| Payback Period | 2.33 years | — |

| 20-Year TCO | $29.4M | ~$34.6M |

| 20-Year NPV @ 6% | $3.2M | — |

| ROI | >450% | — |

A biomass boiler with strong fuel savings can outperform fossil boilers in TCO and NPV even with higher upfront cost.True

Lower fuel cost and environmental benefits offset capital investment within a few years.

📋 Best Practices for Biomass Feasibility Modeling

| Practice | Why It Matters |

|---|---|

| Use real fuel cost and escalation trends | Fuel savings drive ROI |

| Include labor, ash, emissions costs | Omitting them underestimates TCO |

| Factor in grants or incentives | Many regions support biomass retrofits |

| Model carbon tax exposure | Increases fossil TCO and improves biomass ROI |

| Run NPV with different discount rates | Reflects financing or risk tolerance |

Use tools like Excel with NPV/PV functions or LCCA software for better accuracy.

Summary

Estimating payback period, TCO, and NPV is essential for evaluating whether a biomass boiler investment will generate real, long-term returns. These financial tools capture the true economic impact of higher efficiency, renewable fuel savings, and operational costs compared to conventional systems. When modeled correctly, many industrial biomass boiler projects show attractive ROI, short payback, and positive NPV—making them not only environmentally sound but also financially strategic. In energy investment, the right numbers don’t lie—they light the path to profitability.

🔍 Conclusion

Performing a lifecycle cost analysis allows you to go beyond the sticker price and fully evaluate the economic sustainability of a biomass boiler system. While fuel savings and renewable benefits are attractive, long-term performance depends on accurate forecasting of operational costs and logistical planning. An effective LCCA ensures your biomass boiler investment delivers value, reliability, and environmental responsibility over its 15–25 year lifespan.

📞 Contact Us

💡 Need help with biomass boiler cost modeling and lifecycle analysis? Our team provides TCO forecasting, fuel logistics consulting, and ROI planning tailored to your industrial biomass system.

🔹 Contact us today to make your biomass boiler project a smart, cost-effective, and sustainable investment! 🌱🔥📊

FAQ

What is lifecycle cost analysis (LCCA) for an industrial biomass boiler?

Lifecycle cost analysis is a method used to calculate the total cost of ownership (TCO) over the operational life of a biomass boiler. It includes all costs:

Capital expenditure (CapEx)

Operating expenses (OpEx)

Fuel, maintenance, emissions compliance, and end-of-life costs

This holistic view helps evaluate the long-term financial viability of biomass systems compared to gas, coal, or oil-fired alternatives.

What cost components are included in biomass boiler LCCA?

Capital Cost – Boiler unit, fuel handling, storage, and installation

Fuel Cost – Type (pellets, chips, agri-waste), price per ton, and moisture content

Operation & Maintenance (O&M) – Ash removal, grate cleaning, tube replacement

Emissions Compliance – Filters, cyclones, baghouses for PM control

Labor & Training – Operators skilled in biomass systems

Disposal or Replacement – End-of-life decommissioning or resale

How is fuel cost calculated in biomass boiler LCCA?

Annual Fuel Cost = Annual Consumption (tons) × Price per Ton

Prices vary by region and fuel type:

Wood chips: $40–$70/ton

Pellets: $150–$250/ton

Agri-residues: $30–$80/ton

Also factor in fuel moisture content, as high moisture reduces combustion efficiency and increases consumption.

What are typical O&M costs over a biomass boiler’s lifespan?

O&M costs for biomass boilers range from 5–8% of capital cost annually, covering:

Ash disposal systems

Tube cleaning and refractory repair

Fuel feed system maintenance

Over 20 years, O&M costs can total $300,000 to $800,000+, depending on system size and complexity.

Why is LCCA important for evaluating biomass boilers?

Biomass boilers often have higher upfront costs but offer long-term savings due to:

Lower, stable fuel prices

Government incentives or renewable energy credits

Carbon neutrality and emissions advantages

LCCA reveals whether the higher initial investment pays off over time, especially when compared to fossil-fuel systems.

References

Lifecycle Costing Methodology – Energy.gov – https://www.energy.gov

Biomass Fuel Cost Guide – EIA – https://www.eia.gov

Total Cost of Ownership in Biomass Heating Systems – https://www.researchgate.net

Industrial Biomass Boiler Economic Assessment – https://www.sciencedirect.com

Maintenance Trends in Biomass Combustion – https://www.epa.gov

Emission Control Technologies for Biomass Boilers – https://www.bioenergyconsult.com

Carbon Credit and Biomass Incentive Programs – https://www.energysavingtrust.org.uk

Biomass Boiler Operations and Maintenance – https://www.mdpi.com

IEA Biomass Plant Cost Guidelines – https://www.iea.org

ASME Standards for Biomass Boiler Design and Cost Analysis – https://www.asme.org